What Is the ESG Policy of Malaysia in 2025/2026?

🌱 Introduction: Why Everyone’s Talking About ESG in Malaysia

So… you’ve been hearing about ESG policies everywhere, right? Whether you’re running an SME, supplying parts to a public listed company (PLC), or just trying to keep up with business trends, the term ESG (Environment, Social, Governance) is popping up like bubble tea shops in KL.

But here’s the big question: What is the ESG policy of Malaysia? And more importantly—what does it mean for your business?

Let’s break it down in a straightforward, kopi-tiam conversation style. No heavy jargons, just what you need to know to stay relevant, compliant, and competitive.

🏛️ First Things First: What Exactly Is ESG?

Think of ESG like three lenses to judge how a company is performing beyond just making money:

- Environment (E):

- How much energy do you use?

- Do you pollute rivers or cut carbon emissions?

- Are you switching to solar or still burning diesel?

- Social (S):

- How do you treat workers?

- Do you ensure fair wages and safe workplaces?

- Are you giving back to the community?

- Governance (G):

- Is your board transparent?

- Do you have anti-corruption policies?

- Are you accountable to stakeholders?

In short, ESG is like the report card for how “responsible” and sustainable your company is.

🇲🇾 So… What Is the ESG Policy of Malaysia?

Now we get to the main keyword (literally 😉).

Malaysia’s ESG policy isn’t just one single document—it’s more like a whole ecosystem of policies, roadmaps, and frameworks. The government has been rolling these out to make sure businesses (big and small) start aligning with sustainability.

Here are the key highlights:

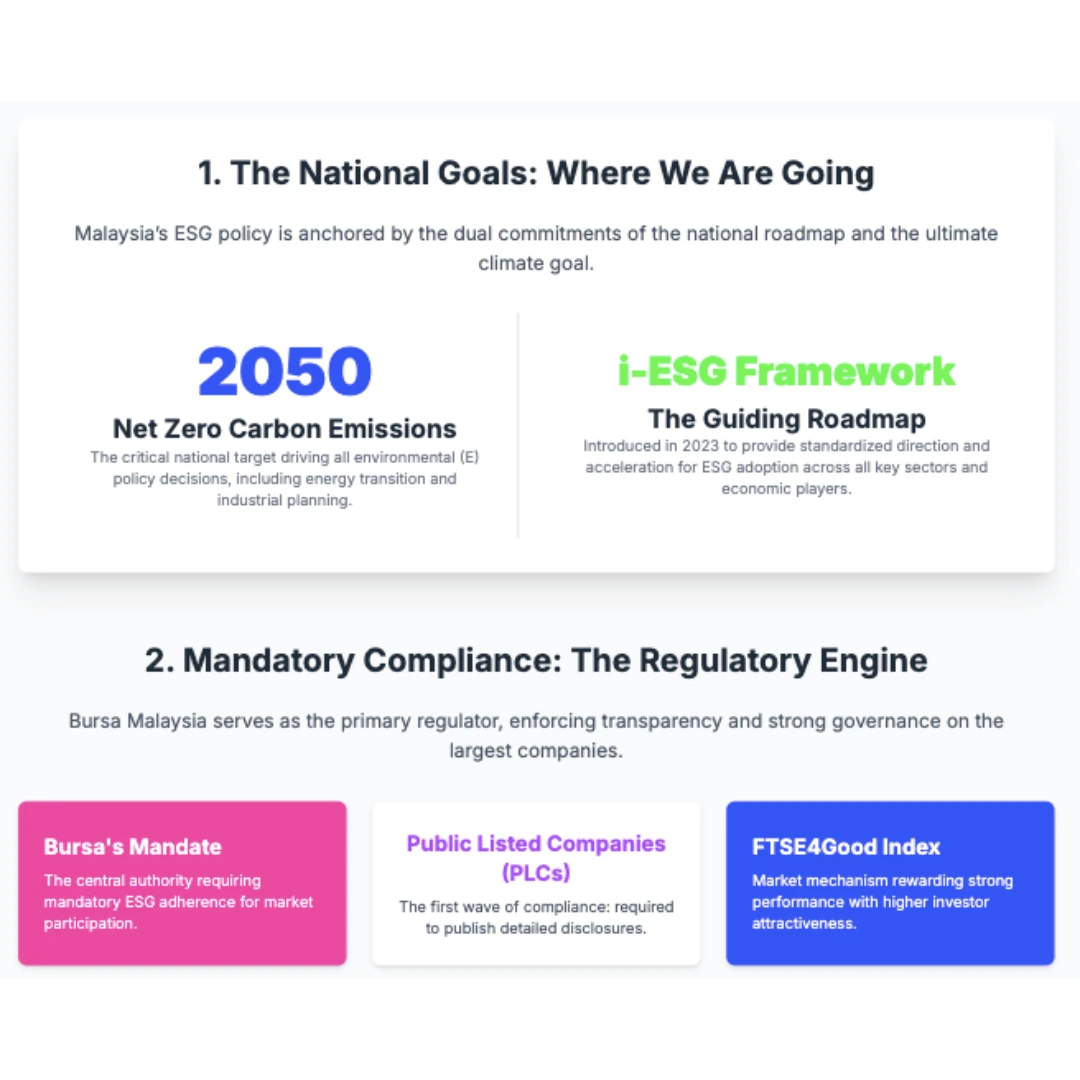

1. National ESG Frameworks

- i-ESG Framework by MITI (2023):

A step-by-step guide for industries to adopt ESG. Phase 1 (2024–2026) is called “Just Transition” to help SMEs get started. - National Industrial Master Plan (NIMP) 2030:

Puts ESG right at the heart of Malaysia’s manufacturing transformation.

2. Bursa Malaysia Requirements

- Since December 2023, all public listed companies (PLCs) must report ESG performance through Bursa’s Sustainability Reporting Platform.

- This means… if you’re a supplier to a PLC, they’ll expect you to have ESG data too.

3. SEDG (Simplified ESG Disclosure Guide)

- Launched in 2023, this guide is specifically designed for SMEs in supply chains.

- It simplifies ESG disclosures into 35 easy indicators—so smaller companies can “speak the same ESG language” as their bigger clients.

4. Government Incentives & Financing

- Green Investment Tax Allowances (GITA), MIDA grants, and SME Corp’s ESG readiness programs help soften the cost of adopting ESG practices.

So when someone asks, “What is the ESG policy of Malaysia?” the answer is:

👉 It’s a national push, combining mandatory rules for PLCs + support and guidance for SMEs, all moving towards net-zero by 2050.

💡 Why Should SMEs Care About ESG Policy?

You might be thinking: “Aiya… this one is for big companies only lah.”

Not true. Here’s why:

- Supply Chain Pressure

- PLCs like Sime Darby, Top Glove, or Nestlé will ask their suppliers (yes, even SMEs) for ESG data.

- If you can’t provide, they might cut you off.

- Tender & Contract Advantage

- Government tenders are starting to include ESG criteria.

- Imagine losing a deal just because your competitor had a proper ESG report.

- Cheaper Financing

- Banks now look at ESG when approving loans.

- With good ESG practices, you can access green loans at lower interest rates.

- Attracting Talent

- Younger employees (Gen Z, Millennials) care about purpose-driven companies.

- If your ESG looks solid, you’re more likely to keep and attract top talent.

🔎 Let’s Zoom In: How Malaysia’s ESG Policy Works in Practice

Here’s the simple flow:

- Government sets policies → like i-ESG, NIMP2030, and net-zero roadmap.

- Bursa mandates PLCs → listed companies must submit ESG reports.

- PLCs pass down requirements → they pressure suppliers to show ESG compliance.

- SMEs adapt using SEDG → SMEs report ESG data in simplified format.

- Banks & Investors reward compliance → easier access to funds, cheaper rates.

It’s like a ripple effect. From Putrajaya → Bursa → PLCs → suppliers → SMEs.

🛠️ How to Start ESG Reporting for Your Business

Okay, enough theory. Let’s get practical. If you’re an SME or supplier in Malaysia, here’s how to ride the ESG wave:

Step 1: Use the SEDG Malaysia Template

- Download the Simplified ESG Disclosure Guide.

- Start with basic reporting: electricity usage, water consumption, waste generated.

Step 2: Focus on Material Issues

- If you’re in manufacturing, focus on energy and waste.

- If you’re in services, focus on labour practices and governance.

- Don’t waste time reporting things that don’t apply.

Step 3: Draft Simple Policies

- Anti-corruption statement.

- Basic HR manual (covering worker rights).

- Safety policy.

Step 4: Keep Records

- Utility bills (electricity, water) → helps track energy/water usage.

- HR records → helps with reporting staff data.

- Training logs → to show investment in employee development.

Step 5: Share With Clients

- Once you compile your ESG numbers, put them in your tender documents.

- Example: “Our company aligns with Malaysia’s SEDG. Scope 1 emissions reduced by 12% last year. No safety incidents in past 12 months. Anti-bribery policy implemented.”

This kind of statement instantly boosts buyer confidence.

🧩 Real-Life Example: The Top Glove Lesson

Remember when Top Glove got banned by the US in 2020 due to labour practice violations (forced labour issues under the “S” in ESG)?

That’s the perfect reminder: even a giant PLC can stumble badly if ESG isn’t handled. The same lessons apply to SMEs—just on a smaller scale.

When Malaysia’s ESG policy says “be transparent and fair,” it’s not just lip service. It directly impacts whether you can export, win tenders, or even keep investors.

🚀 Future of ESG in Malaysia: Where Is This Heading?

Malaysia isn’t slowing down. Here’s what’s coming:

- Mandatory Reporting Expands

- SMEs may soon face mandatory disclosures if they’re in high-impact industries.

- Carbon Tax & Credits

- Expect carbon pricing to come into play by 2030.

- Companies with clean ESG data will benefit from selling carbon credits.

- Global Standards Alignment

- Malaysia’s ESG rules are increasingly aligned with ISSB, GRI, and TCFD.

- This means your disclosures will also work globally, not just locally.

In short, what is the ESG policy of Malaysia? It’s a growing ecosystem that will only get stricter. Better to start early, before it becomes a burden.

✅ Conclusion: Don’t Wait, Start Your ESG Journey Today

So now, when someone asks: “What is the ESG policy of Malaysia?” you can confidently say:

“It’s a combination of government roadmaps, Bursa reporting rules, and simplified tools like SEDG Malaysia—all pushing companies toward sustainability and net-zero by 2050.”

But more than knowing… the real edge is in doing. Start small, track what matters, and report consistently. This way, your business stays relevant, competitive, and ready for any PLC or government contract.

👉 Want to learn how to prepare a simple SEDG Malaysia report for your company? Let’s have a chat. Better to start now than scramble later. Click here now.