How ESG Affects Business In Malaysia 2025

🌱 Let’s Start With the Big Question

Everyone seems to be talking about ESG these days. Banks mention it when you apply for loans. Investors ask about it during pitch meetings. Even suppliers bring it up in casual chit-chat.

But really — How ESG Affects Business In Malaysia 2025?

If you’re an SME owner, a supplier to a public listed company (PLC), or even just starting out, the whole ESG thing might feel a bit abstract. Like, is it just a “trend”? Or is it something that will actually affect your bottom line?

Here’s the truth: ESG is no longer optional. It’s directly shaping how businesses operate, how they get funded, how they win contracts, and even how they attract talent.

🤔 Quick Refresher: What Exactly Is ESG?

Before we dive in, let’s break down the jargon (Malaysian-style, lah).

- E = Environment 🌍

Think energy use, waste management, carbon emissions, renewable resources. Basically, how “green” is your business? - S = Social 👥

This is about people: fair wages, safe workplaces, diversity, equal opportunities, training execution , and community engagement. - G = Governance 🏛️

This part covers leadership, transparency, ethics, and anti-corruption policies.

In short, ESG is like a 3-in-1 kopi-O packet — you need all three elements for the full flavour.

📌 How ESG Affects Business: The Real Impact

So now, let’s get into the meat of it. Here’s how ESG affects business, especially in Malaysia.

1. Funding and Loan Approvals 💰

Banks and investors are no longer just looking at your revenue numbers. They’re asking: “Do you have ESG practices?”

- Example: Maybank, CIMB, and RHB have already started ESG-linked financing products. If your company can show ESG compliance, you get better access to loans, sometimes even at lower interest rates.

- On the flip side, companies with poor ESG practices may face higher borrowing costs or even rejection.

👉 So yes, ESG literally affects your ability to get money.

2. Winning Contracts with PLCs & MNCs 📑

If you’re a supplier, this one’s big.

- PLCs in Malaysia (like Sime Darby, Petronas, Top Glove) are mandated by Bursa Malaysia to report ESG performance.

- This means they’ll ask their suppliers (yes, SMEs like you) to provide ESG data too.

No ESG report = no contract.

This is where the Simplified ESG Disclosure Guide (SEDG) comes in — designed for Malaysian SMEs to align with supply-chain ESG reporting.

3. Regulatory Compliance ⚖️

The government isn’t staying quiet.

- MITI’s i-ESG Framework is already rolling out in phases, starting 2024.

- National Industrial Master Plan 2030 (NIMP2030) pushes ESG adoption for all manufacturers.

- Expect carbon tax and stricter reporting rules within the decade.

So, if you’re not aligned with ESG now, you’ll be scrambling later when the rules get tighter.

4. Reputation and Branding ⭐

Malaysians are becoming more conscious. Consumers are asking:

- “Is this product sustainable?”

- “Does this company treat workers fairly?”

A good ESG track record boosts your brand equity. A bad one? It could destroy your reputation overnight.

Case in point: Remember when Top Glove got banned by the US over forced labour issues? Billions wiped out in valuation. That’s how ESG affects business, loud and clear.

5. Employee Attraction & Retention 👩💼

Let’s be real: the younger workforce (Gen Z and Millennials) don’t just look at salary anymore. They ask:

- “What does this company stand for?”

- “Do they have a safe, inclusive workplace?”

Companies with strong ESG practices find it easier to attract and keep good talent. Those without? High turnover, high hiring costs.

6. Operational Efficiency ⚙️

ESG isn’t just about compliance — it can actually save you money.

- Energy efficiency = lower utility bills.

- Waste reduction = lower disposal costs.

- Safer workplace = fewer accidents, lower insurance costs.

So ESG practices can directly improve your bottom line, not just your reputation.

7. Investor Confidence 📈

Both local and foreign investors now factor ESG into valuations.

- A Bursa Malaysia study showed that companies in the FTSE4Good Index (ESG-compliant PLCs) enjoy higher valuations compared to peers.

- Why? Because investors see them as lower risk, more future-proof, and more profitable long-term.

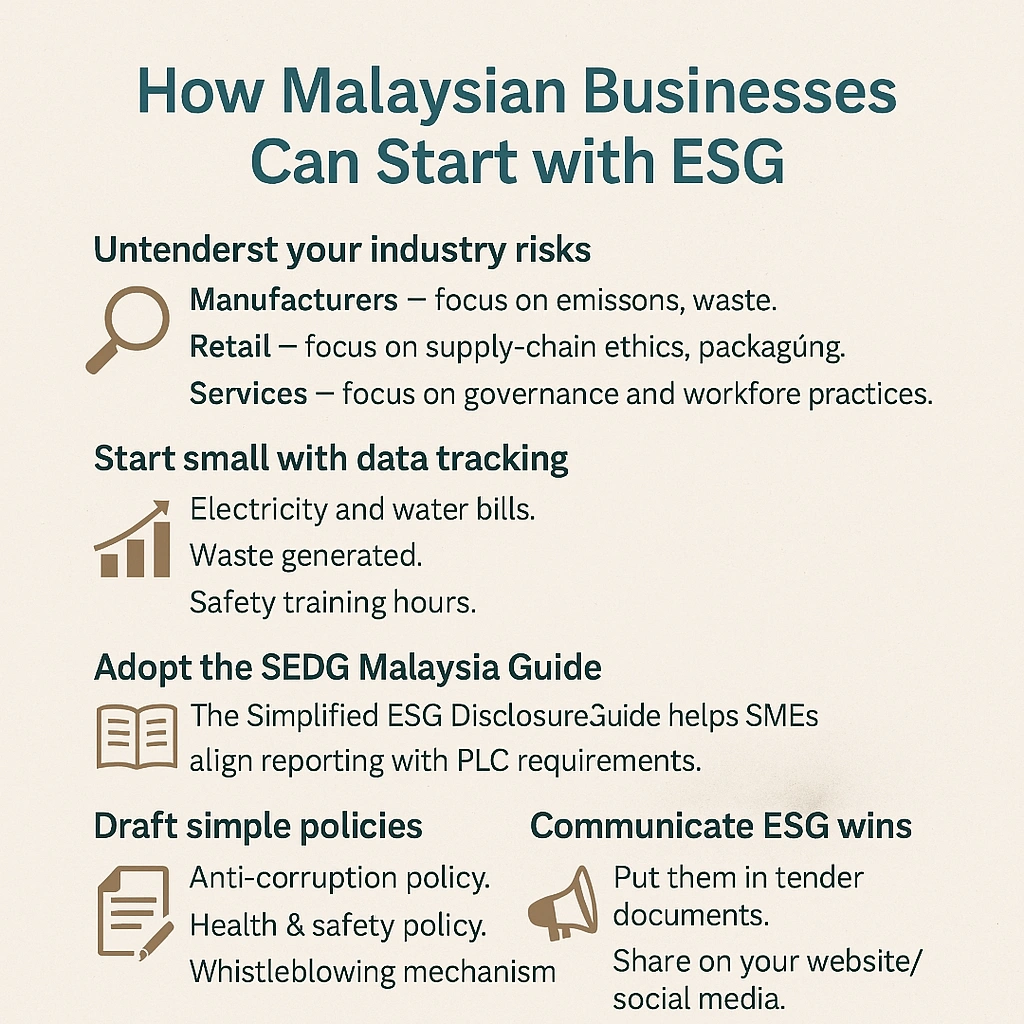

🛠️ How Malaysian Businesses Can Start with ESG

Now that you know how ESG affects business, the next question is: “How do I get started?”

Here’s a simple roadmap:

- Understand your industry risks

- Manufacturers → focus on emissions, waste.

- Retail → focus on supply-chain ethics, packaging.

- Services → focus on governance and workforce practices.

- Manufacturers → focus on emissions, waste.

- Start small with data tracking

- Electricity and water bills.

- Waste generated.

- Safety training hours.

- Electricity and water bills.

- Adopt the SEDG Malaysia Guide

- The Simplified ESG Disclosure Guide helps SMEs align reporting with PLC requirements.

- The Simplified ESG Disclosure Guide helps SMEs align reporting with PLC requirements.

- Draft simple policies

- Anti-corruption policy.

- Health & safety policy.

- Whistleblowing mechanism.

- Anti-corruption policy.

- Communicate ESG wins

- Put them in tender documents.

- Share on your website/social media.

- Use it to differentiate your brand.

- Put them in tender documents.

📊 Real Malaysian Examples of ESG in Action

- Sime Darby Plantation: Moved aggressively into ESG to counter forced labour allegations. Now re-accepted by international buyers.

- Nestlé Malaysia: Switched to 100% paper straws in Milo drinks — a small step, but powerful branding.

- Local SME suppliers: Many are now using solar rooftops and reporting reductions in emissions to stay in supply chains.

These show that ESG is not just a “big company thing”. SMEs that adapt early are already seeing the benefits.

🚀 The Future: ESG in Malaysia (2025 and Beyond)

Here’s where things are heading:

- Carbon pricing & carbon markets: Likely by 2030. Reuters reported that Malaysia’s carbon exchange hosted its first local carbon credit auction in July 2024

- Mandatory SME disclosures: Especially if you’re in high-impact industries.

- Investor push: More funds will only invest in ESG-compliant companies.

- Consumer behaviour: More Malaysians choosing sustainable brands.

So if you’re still asking “How does ESG affect business?” — the answer is: It affects EVERYTHING. Funding, branding, compliance, contracts, and even day-to-day operations.

✅ Conclusion: Don’t Wait, Start Now

To put it simply, ESG is like Waze for your business journey. Without it, you’re just driving blindly, hoping to reach the destination. With it, you get a clear route, avoid roadblocks, and actually reach the goal faster.

So the next time someone asks you “How ESG affects business?”, you can say:

👉 It affects money, contracts, reputation, staff, and growth.

👉 It’s not optional anymore — it’s survival.

Better to start small today, than scramble tomorrow when clients, banks, and regulators are all knocking on your door.

👋 Ready to start your ESG journey? Begin with small steps — track your energy, draft simple policies, and explore SEDG Malaysia. If you need a guide, reach out — let’s make ESG your business advantage, not just another compliance headache.